Value-added tax (VAT) refers to a type of indirect tax that is imposed on the supply of most goods and services. The VAT is charged and collected at each stage of the supply chain. It is generally the final consumers who bear the VAT cost while businesses collect and account for the tax.

In the UAE, there are primarily two VAT rates applicable: The standard rate of 5% and the zero rate of 0%. Although VAT is not accounted for in respect of both zero-rated and VAT exempt supplies, there is an important distinction between the two.

What is a Taxable Supply?

Most business transactions are based on the supply of goods or services. To be taxable, some conditions would generally need to be met. Hence, the supply:

- should be a good or service

- needs to be done for a consideration

VAT may be charged at either the 5% standard rate or the 0% rate for taxable supplies. As mentioned earlier, some supplies are exempted from VAT and hence, are not considered as taxable supplies.

Types of VAT

Depending on the nature of supplies, UAE VAT can be classified into three major categories:

1. Standard Rated VAT

A VAT rate of 5% is applicable to the supply & import of most of the goods & services in the UAE. The country’s law states that when a business is registered for VAT and VAT is charged at the standard rate, the company may be entitled to recover the VAT charged by its supplier (terms and conditions may apply).

2. Zero Rated VAT

The VAT is not accounted for on zero-rated supplies (since the applicable rate is 0%), but such supplies are still treated as “taxable supplies” in all other respects. As a result, the person making the supply has the right to recover the VAT incurred on their own business expenditure in the same way as they would if they made standard-rated supplies. According to Article (45) of. The Federal Decree no. 8 of 2017 on VAT, the zero rate shall apply to the supply of the following goods & services:

- A direct or indirect export of goods & services to outside the Implementing States.

- International transport of passengers and Goods which starts or ends in the State or passes through its territory, including Transport-related Services.

- Supply of air, sea, and land means of transport for the transportation of passengers and Goods.

- Supply of Goods and Services related to the supply of the means of transport mentioned above and which are designed for the operation, repair, maintenance, or conversion of these means of transport.

- The first supply of residential buildings within (3) years of its completion.

- Supply of aircrafts or vessels designated for rescue and assistance by air or sea.

- The supply or import of investment precious metals.

- The supply of preventive and basic healthcare Services and related Goods and Services.

- The supply of educational services and related Goods and Services for nurseries, preschool, school education, and higher educational institutions owned or funded by Federal or local Government.

- The first supply of buildings specifically designed to be used by Charities.

- The first supply of buildings converted from non-residential to residential.

3. VAT-exempted supplies

Products and services in this category are not subject to VAT. It means they do not incur VAT charges at the time of purchase or sale. In addition, businesses which are in the business of making mixed supplies with varying VAT liability will have to apportion VAT incurred on general costs.

According to Article (46) of. The Federal Decree no. 8 of 2017 on VAT, the following supplies are exempt from VAT:

- Financial services which are not conducted for an explicit fee, discount, commission, rebate, or similar type of consideration, such as life insurance and reinsurance of life insurance.

- Residential buildings, other than the residential buildings which are specifically zero-rated.

- Bare Land.

- The local passenger transport.

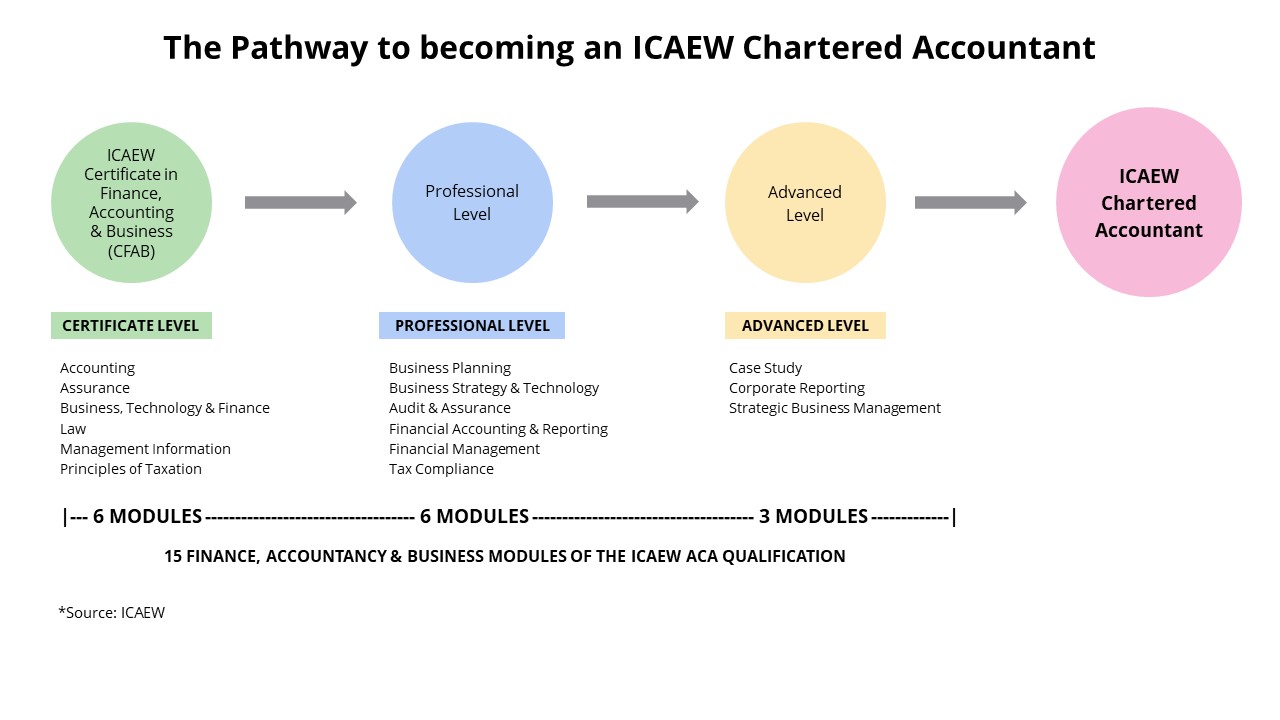

If you are interested in attaining a Certified Diploma in VAT for the Middle East region, then Kaplan Professional Middle East is here to help you achieve it with the support of the industry’s leading taxation trainers.

Information Source: Creative Zone Tax & Accounting